Real Estate Market Analysis in Mexico

Objective

The goal of this project was to analyze the Mexican real estate market to uncover trends, pricing factors and potential investment opportunities. By using publicly available datasets, we aimed to provide actionable insights to help both buyers and investors make data-driven decisions.

Tools & Technologies

- Python: For data cleaning, analysis and machine learning model development.

- SQL: For querying real estate databases and extracting relevant data.

- Power BI/Tableau: For visualizing property trends and pricing comparisons across regions.

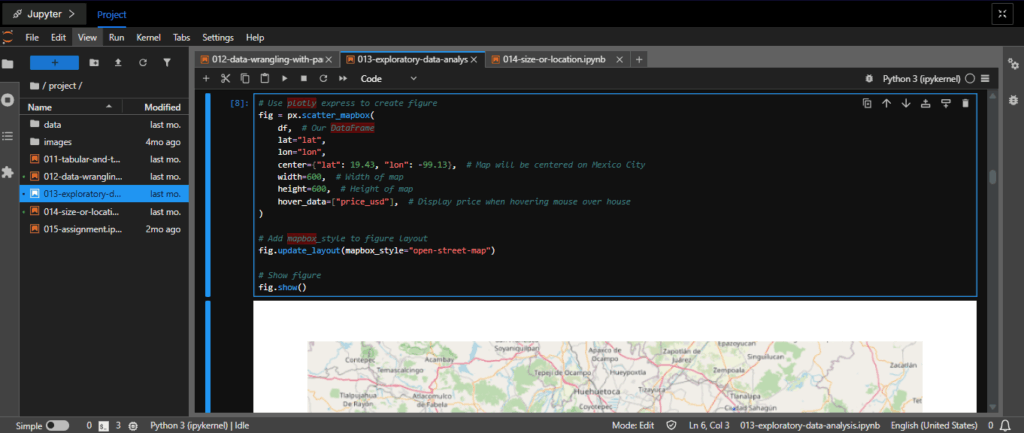

- Jupyter Notebooks: For presenting data analysis and model results interactively.

Process

- Data Collection & Cleaning

- Collected real estate datasets from various online sources, including property listings and regional price data.

- Cleaned and preprocessed the data, addressing missing values and inconsistencies to ensure reliability.

- Exploratory Data Analysis (EDA)

- Conducted EDA to understand the distribution of property prices across cities and types.

- Analyzed variables like location, size and the number of rooms to determine their influence on pricing.

- Visualization

- Created visual dashboards showing the relationship between property characteristics (size, location, etc.) and pricing trends.

- Used heatmaps and scatter plots to identify areas with the highest property value fluctuations.

- Predictive Analysis

- Developed a simple linear regression model to predict property prices based on features like size, number of rooms and location.

- Evaluated model accuracy using metrics like Mean Absolute Error (MAE).

Insights & Findings

- Location Matters Most: Properties in major cities like Mexico City and Guadalajara showed a significantly higher price per square meter compared to rural areas.

- Property Size: Larger properties had a stronger price correlation, especially in urban areas where demand is higher.

- Price Trends: We identified a growing demand for smaller, affordable apartments, especially in areas close to public transport hubs.

Impact

- The analysis highlighted key investment hotspots in Mexico and helped identify underpriced properties that could yield high returns.

- It also provided a valuable decision-making tool for first-time homebuyers and real estate agents seeking to optimize listings.

Testimonial

“This analysis provided real-time insights into the market, helping us identify growth opportunities in underdeveloped areas. A great use of data to inform decision-making.” — Real Estate Investment Group